The Individual Mandate: Reporting Coverage and Paying Penalties

A key provision of the Affordable Care Act (ACA) is the individual mandate, which requires most individuals to purchase health insurance coverage for themselves and their family members or pay a penalty.

A key provision of the Affordable Care Act (ACA) is the individual mandate, which requires most individuals to purchase health insurance coverage for themselves and their family members or pay a penalty.

Starting in 2015, individuals will have to report on their federal tax return whether they had health insurance coverage for 2014 or were exempt from the individual mandate. Any penalties that an individual owes for not having health insurance coverage will generally be assessed and collected in the same manner as taxes.

How will coverage be reported under the individual mandate?

Starting in 2015, when you file a federal tax return for 2014, you will have to:

- Report that you, your spouse (if filing jointly) and any individual you claim as a dependent had health care coverage throughout 2014; or

- Claim a coverage exemption from the individual mandate for some or all of 2014 and attach Form 8965; or

- Pay an individual mandate penalty (called a shared responsibility payment) for any month in 2014 that you, your spouse (if filing jointly) or any individual you claim as a dependent did not have coverage and did not qualify for a coverage exemption.

If you and your dependents all had minimum essential coverage for each month of the tax year, you will indicate this on your 2014 tax return by simply checking a box on Form 1040, 1040A or 1040EZ; no further action is required. If you obtained a coverage exemption through your workplace, you will file Form 8965 and attach it to your tax return.

For any month you or your dependents did not have coverage or a coverage exemption, you will have to make a shared responsibility payment. The amount of the payment due will be reported on Form 1040, Line 61, in the “Other Taxes” section, and on the corresponding lines on Form 1040A and 1040EZ.

The penalty for not obtaining acceptable health care coverage is being phased in over a three-year period. The amount of the penalty is either your "flat dollar amount" or your "percentage of income amount" - whichever is greater.

For 2014, the annual penalty is either:

- One percent of your household income that is above the tax return filing threshold for your filing status; or

- Your family’s flat dollar amount, which is $95 per adult and $47.50 per child, limited to a family maximum of $285.?

Your payment amount is capped at the cost of the national average premium for a bronze level health plan, available through the Marketplace in 2014. For 2014, the annual national average premium for a bronze level health plan available through the Marketplace was $2,448 per individual ($204 per month), but $12,240 for a family with five or more members ($1,020 per month). For 2015, the annual national average premium for a bronze level health plan available through the Marketplace is $2,484 per individual ($207 per month), but $12,420 for a family with five or more members ($1,035 per month).

Calculating your payment requires you to know your household income and your tax return filing threshold.

Household income is the adjusted gross income from your tax return plus any excludable foreign earned income and tax-exempt interest you receive during the taxable year. Household income also includes the adjusted gross incomes of all of your dependents who are required to file tax returns.

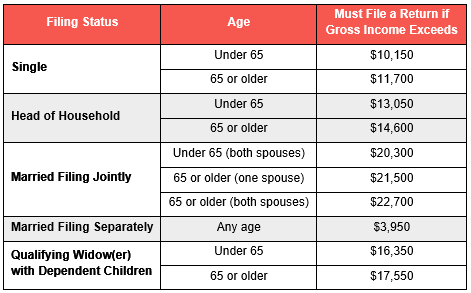

Tax return filing threshold is the minimum amount of gross income an individual of your age and filing status (for example, single, married filing jointly, head of household) must make to be required to file a tax return.

2014 Federal Tax Filing Thresholds

The IRS will generally assess and collect individual mandate penalties in the same manner as taxes, with certain limitations. As a result, any penalty under the individual mandate will likely be subtracted from the tax refund that the individual is owed, if any.

Source: Internal Revenue Service