The Benefits of Claims Recovery & Subrogation

How transportation companies stand to profit by going on offense to recover claims.

As economic and regulatory pressures continue to mount, some logistics and trucking companies are turning subrogation and claims recovery efforts into a viable revenue stream. TrueNorth and Recovery Concepts & Solutions (RCS) explain this approach and reveal how trucking companies can profit by pursuing overlooked funds.

RCS President and TrueNorth strategic partner, Erik Stremke, specializes in subrogation and tort recovery, providing superior customized services to clients across several product lines.

Generating profit in an era that expects companies to 'do more with less'

Today’s transportation companies are juggling a lot: in addition to the issues above, trucking companies face rampant litigation, high driver turnover and a hardened insurance market - all making it more difficult to turn a profit. In response, some logistics companies have set their sights on claims recovery and subrogation, using recovered funds to fuel their enterprise.

Erik Stremke serves as president of RCS. In this position, he leads a team of recovery specialists expertly trained in pursuing funds from past claims damages. With payment contingent on recovery, Erik and team take on the risk and transportation companies reap the reward.

How subrogation leads to savings

When making the decision to pursue subrogation and recovery, Stremke often fields questions from executives like, “where do I find the funds?” and “how much work does my team have to do?” His response is straightforward: “This is your money and it belongs in your bank account - not someone else’s. Let us retrieve it for you.”

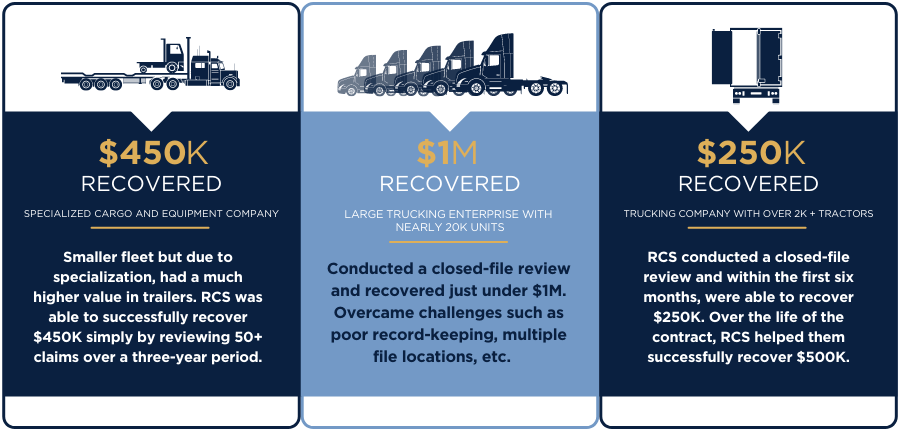

With payment contingent upon claims recovered, there is no upfront cost. Secondly, the subrogation team is trained to efficiently investigate closed claims files. The team conducts a careful review, locating files that fall within the statute of limitations and initiating recovery efforts – this method has successfully recovered millions of dollars in claims.

How transportation companies benefit

Traditionally, claims teams must operate swiftly to efficiently process, defend, and handle incoming claims. The RCS team takes a reverse approach, initiating activity and leveraging resources to aggressively pursue and recover funds. “Think of it this way,” says Stremke. “If claims recovery were a hockey game, your internal claims team guards your goal while our subrogation team pursues the puck.”

This allows the internal claims team to focus on processing claims, while subrogation specialists pursue fund recovery – sending emails, making calls and demanding payment from appropriate parties to recover funds and ensure they are returned to your organization.

There is a lot of money out there. Let RCS retrieve it for you.

TrueNorth and RCS serve as extended resources for your established claims team. Contact TrueNorth’s Risk Solutions team to learn more about subrogation and determine if this approach is right for your business. Contact Zach Hawkins and the Risk Solutions team to learn more.

Contact Zach

This publication has been prepared by TrueNorth Companies, L.C. and is intended for informational purposes only. Transmission of this publication is not intended to create, and receipt does not constitute, a client relationship with TrueNorth Companies, L.C. This publication does not constitute any type of representation or warranty, and does not constitute, and should not be relied upon as, legal advice. This publication is not a contract and does not amend, modify or change any insurance policy you may have with an insurance carrier. © 2021 TrueNorth Companies, L.C. All rights reserved.