Nonqualified Deferred Compensation (NQDC) Plan

posted by TrueNorth Transportation on Wednesday, July 25, 2018

The following blog post features content from the Advanced Consulting Group of Nationwide. You can access an unabridged copy of Advanced Marketing Concepts here.

The Concept

Your business clients know that once they've secured top talent, it's important to keep those individuals happy. One way to show them they're appreciated is with a nonqualified deferred compensation plan (NQDC) funded with life insurance.

Benefits

With a nonqualified deferred compensation plan, the employer gives the key employee the opportunity to save for retirement through salary deferrals, company contributions or a combination of both. It's both a recruiting and retention tool for employees who are specialized or valued employees and has less administration and fewer filing requirements than qualified plans subject to ERISA.

NQDC plans offer flexibility in plan design to meet specific needs, and if informally funded with life insurance, the corporation, as the beneficiary, will receive the death benefit which can be sued to recover costs associated with the plan.

Tax considerations

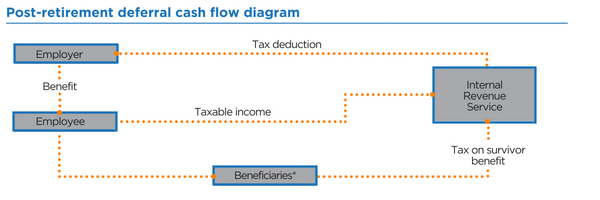

- There is no immediate tax deduction for the employer.

- The business gets to take a tax deduction when an employee receives distributions from the plan and the employee is taxed as ordinary income.

- There's no impact on existing qualified retirement plans - you can have both a qualified retirement plan and an NQDC plan.

Steps

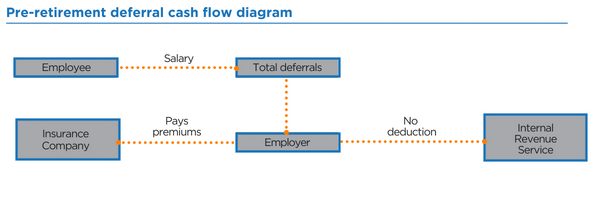

- The employer puts the plan in place and salary deferrals (and possibly employer contributions) begin.

- The employer may choose from purchase life insurance on some or all eligible employees to informally fund the plan.

- The plan uses contributions to fund the life insurance premiums.

- Upon a qualifying event, such as retirement, disability or separation from service, benefits are paid to the employee.

How it works

*If the employee dies during post-retirement distribution (or pre-retirement employment), there may be distributions payable and taxed to the employee's beneficiaries.

Learn more from TrueNorth

For more information on Nonqualified Deferred Compensation, contact Jacob Schulte. Jacob's primary focus at TrueNorth is on developing executive compensation and retention programs for privately-held businesses.

Contact Jacob

About Author

TrueNorth has a team of dedicated transportation staff with deep specialization to each facet in the industry. Our solutions beyond the insurance policy help transportation companies reduce risk in new, innovative ways. Learn more about the solutions we offer here or call us at (800) 798-4080.

... read more about author