Driving the Numbers: The Commercial Insurance Market and Litigation Reform

posted by TrueNorth Transportation on Wednesday, December 18, 2019

Over the past few months, I have been given the opportunity to present at multiple industry events on a variety of topics. The two items that keep coming up in discussion and seem to be on the mind of all facets of the transportation industry are insurance costs and the litigious operating environment. At a high level, I will attempt to provide an update on each.

Commercial Insurance Market

It’s not good – next topic.

No seriously, during my 30 years in the insurance industry, this is about the toughest operating environment I have witnessed. That is true for both the trucking companies and the insurance carriers. The rules we have long played by are shifting and costs are rising for all that are involved. By and large, the insurance carriers that provide auto liability and excess coverage to the trucking industry have lost money since 2010 and have performed even worse than business auto insurers in general.

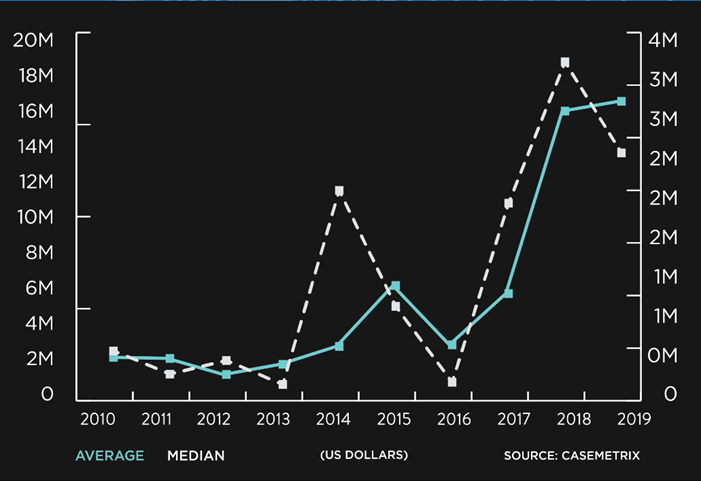

You may have seen the recent FreightWaves article on the size of legal awards against trucking companies. The below chart is telling. The bottom line: according to the CaseMetrix data, the average verdict against a trucking company in 2012 was about $2.6 million. Now it’s more than $17 million.

Average Verdicts Against Trucking Companies

Willis Towers Watson (“WTW”) recently updated their Insurance Marketplace Realities 2020, pointing to “social inflation” as a contributor to spiking auto liability and general liability rates.

Driven by the severity of claims and a reduction in insurance capacity WTW predicts excess insurance costs to increase dramatically, stating that accounts with large commercial fleets are still seeing significant increases in the lead umbrella pricing (25%+) after already enduring several years of increases. These increases are also putting upward pressure on the following excess layer pricing.

Excess capacity continues to contract, and many motor carriers are finding it difficult to fill out their excess towers. Just as trucking companies try to protect their balance sheets by purchasing excess coverage, so do the excess underwriters by reducing the amount of risk they take in any one loss or for any one client. Motor carriers are now finding themselves competing for excess capacity as opposed to excess underwriters competing for their business.

Nationwide recently released what they have termed to be the “Big 3” loss types that are driving the majority of commercial auto claims:

- Lane Departures – A factor in 60% of all road fatalities

- Rear-end collisions – 34% of all vehicle crashes annually

- Hitting pedestrians or cyclists – Nearly 6,000 fatalities in 2016

When I think about those statistics a few things come to mind:

- These claims all normally involve legal representation.

- What difference would it make if there were video footage?

- How seldom the professional truck driver is at fault and needs to be defended.

Legal & Tort Reform Initiative

The current legal and social environment is not sustainable from a commercial standpoint. It is adversely, and in many cases, unfairly driving outcomes that are hurting the industry today and will ultimately hurt the economy and consumers directly.

Improving the situation will be hard, but since we are in trucking, we have a shared affinity for doing hard things. ATA has stepped forward to assume a leadership role, addressing what is now a Tier One priority for the association. Strategies include:

- Federal (legislation, regulatory, education and coalitions)

- State (centralized “what works” library, state legislative and ballot advocacy, state courts and support grants)

- Education (supporting ATA Members – Member Education Hub)

- Public Affairs/Communications (educating the general public)

The trucking industry is not in this fight alone and the coalition of supporting partners is growing. The issues are not limited to trucking, but rather affect all companies operating commercial autos. The detrimental impact upon business and consumers is staggering. It is time to stand up.

We can’t undervalue the importance of public affairs and education. At a recent meeting, which ATA held with several executives from transportation insurance carriers, there was broad agreement that any successful attempt at litigation reform must include a strong public education component.

This effort will not end quickly, nor will some of the results appear until well down the road. That said, there are opportunities to get wins. State associations are already stepping forward to offer their support of specific issues where we can get a foothold and create a template for other states to follow.

The strategy will also not be cheap. A key to success will be for all of those affected to contribute and to do so in a way that we can leverage our resources towards common objectives. It will take contribution from the trucking companies themselves, the insurance carriers, the OEMs and other associated companies that benefit from their affiliation with the transportation industry. It will also require aligning these resources with other industries and national groups that recognize the harm that run-away litigation is causing to our industry, our country and the communities that we serve.

You can directly track the negative impact that this legal environment is having on investment and perhaps most importantly, jobs. It drives up the cost of insurance for all drivers, not just those in trucks, and makes consumer products more expensive. It is time to get that word out!

Best Practices in a Hard Insurance Market

Think about the commercial slide deck that your sales and executive team have built to present your company’s service offerings to your best and largest prospects. Do you have something similar relative to risk? How do you present yourself in a distinguishing way to the insurance market?

NAFC has developed a white paper to assist members as they consider how to best position themselves in a hard insurance market. This piece is available to NAFC members as a resource for your business. You should see the release soon.

The financing of risk is no longer just a purchasing activity, nor can it be an activity that a motor carrier undertakes once a year leading up to a renewal date. You must actively work your management of risk and your relationships with your underwriting facilities.

Someone always gets the best deal. That is true when it comes to buying insurance. As I look at our benchmarking data, I see a vast difference between the customers that have the lowest rates and similar companies who pay significantly more. Why is that? It is often driven by the motor carrier’s approach, their control over the process and how proactively they drive results.

The difficult insurance market in part ties to the poor litigation environment. In the short term, neither is likely to improve soon or without our involvement. In the meantime, managing risk and the financing of risk as core components of your organization’s operating strategy can help you get the “best deal” available.

J. Daniel Cook, CPCU, CIC, ARM, AMIM, AAI, AU, TRS

Principal & National Transportation Practice Leader

TrueNorth Companies, L.C.

A print-friendly version available here.

This publication has been prepared by TrueNorth Companies, L.C.’s Transportation division and is intended for informational purposes only. Transmission of this publication is not intended to create, and receipt does not constitute, a client relationship with TrueNorth Companies, L.C. This publication does not constitute any type of representation or warranty, and does not constitute, and should not be relied upon as, legal advice. This publication is not a contract and does not amend, modify or change any insurance policy you may have with an insurance carrier. © 2019 TrueNorth Companies, L.C. All rights reserved.