Solving for Risk in the Last Mile Sector

posted by TrueNorth Transportation on Monday, February 13, 2017

As an industry leader for nearly 20 years, TrueNorth has kept a watchful eye on transportation’s evolving landscape. Within the last decade, the Last Mile sector has grown exponentially - and along with it, the daunting challenge of properly protecting businesses that are operating in it. In an effort to confront these complex risks and evolve alongside the industry, TrueNorth has assembled a team geared to offer solutions that meet the precise needs of the growing Last Mile enterprise.

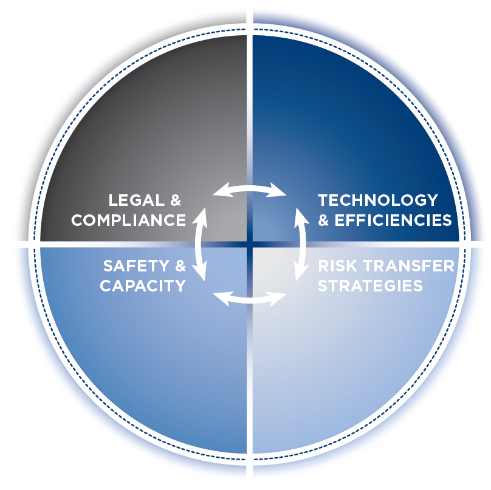

We begin by considering Last Mile risks as they relate to four distinct quadrants: Legal & Compliance, Safety & Capacity, Technology & Efficiencies, and Risk Transfer Strategies. This four quadrant strategy developed by TrueNorth helps ensure that a balanced and holistic approach to enterprise risk management is successfully adopted and sustained. Quadrant by quadrant, we consider the unique and common risks facing a third-party logistics company (3PL) that typically operates as a broker/freight forwarder. Once relevant risks are identified, we design, present and implement solutions to tackle them. As we examine each of these four quadrants, we’ll discuss solutions that we’ve developed that directly impact three key themes in Last Mile enterprise risk management:

We begin by considering Last Mile risks as they relate to four distinct quadrants: Legal & Compliance, Safety & Capacity, Technology & Efficiencies, and Risk Transfer Strategies. This four quadrant strategy developed by TrueNorth helps ensure that a balanced and holistic approach to enterprise risk management is successfully adopted and sustained. Quadrant by quadrant, we consider the unique and common risks facing a third-party logistics company (3PL) that typically operates as a broker/freight forwarder. Once relevant risks are identified, we design, present and implement solutions to tackle them. As we examine each of these four quadrants, we’ll discuss solutions that we’ve developed that directly impact three key themes in Last Mile enterprise risk management:

- Controlling risk at an enterprise level and the resulting effect on fixed versus variable costs.

- Adopting best practices that further protect the enterprise from the threat of negligent entrustment and independent contractor misclassification.

- Leveraging third-party resources and technologies to maximize workflow efficiencies and capacity.

Legal & Compliance

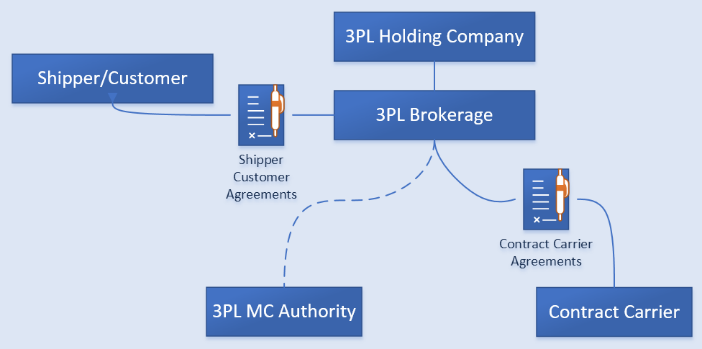

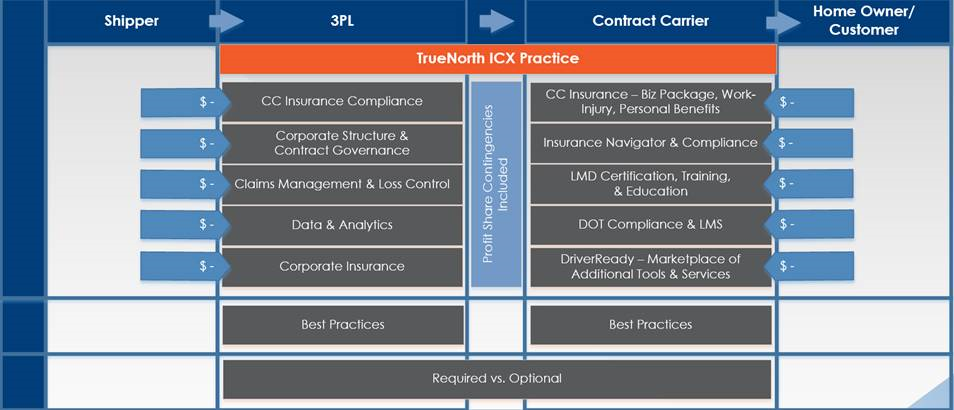

One of the evolutions we’ve witnessed within the transportation industry (and specifically Last Mile) is the transition at an enterprise level from motor carrier to property broker, and the transition at the contractor level from independent contractor to contract carrier. A critical first step in our engagement with the 3PL is an assessment of their current corporate structure. The image to the right depicts ideal state for most of our 3PL clients.

One of the evolutions we’ve witnessed within the transportation industry (and specifically Last Mile) is the transition at an enterprise level from motor carrier to property broker, and the transition at the contractor level from independent contractor to contract carrier. A critical first step in our engagement with the 3PL is an assessment of their current corporate structure. The image to the right depicts ideal state for most of our 3PL clients.

Next, we examine the agreements currently in place with shipper customers, third-party vendors, and contract carriers. The goal of contract governance is to identify opportunities to limit the 3PL’s liability and verify insurance levels are adequate and reflect the right exposures and risks.

Customer / Shipper Service Agreements: First, we verify the 3PL is insured properly to meet their contractual obligations. Once this is accomplished, we look for opportunities to transfer requirements and/or better define the scope of work by limiting the 3PL’s liability, provided certain operational criteria are met. For example, we assist the 3PL by exploring contract language in their shipper agreements that specify a series of tasks the installer must perform to document work they conduct on each install. If completed properly, the 3PL limits their liability for losses tied to completed and ongoing operations.

Contract Carrier Service Agreements: TrueNorth engages the help of subject-matter experts in transportation law to develop a set of best practice insurance requirements for last mile contract carriers. These requirements accurately contemplate the work that the contract carrier performs to protect against any uncovered claims that may arise from work performed by an underinsured or improperly insured contractor.

Negligent Entrustment & Misclassification: Our last example in this quadrant relates to operational best practices put in place to protect the 3PL from the risk of negligent entrustment of a shipment to an improperly licensed motor carrier and independent carrier misclassification tied to improper hiring and engagement practices.

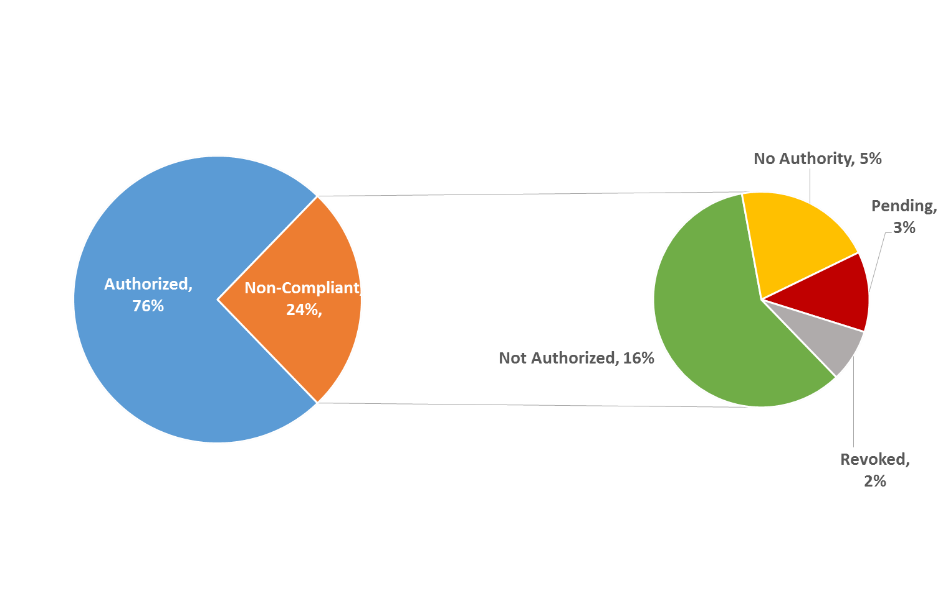

It is critical to establish processes that verify the contract carriers’ operating authority at the start of the contract and then continue to monitor their status. Part of our engagement with the 3PL includes an assessment of the current state among their contract carrier network. The chart below illustrates what we have found: that 24% of the industry’s existing contract carrier network is non-compliant due to lack of active authority, or having pending or revoked authority.

Safety & Capacity

Today’s transportation landscape calls for decisions to be informed and data-driven. Safety is no different, as continual improvement is key to minimizing risks while operating on the road and in the consumer’s home. TrueNorth recognized a need to formalize concepts and subject-matter expertise and as a result, developed Risk Solutions. Based on collaboration and a top-down adoption of core safety principles, Risk Solutions is comprised of iNERGY, TrueNorth’s proprietary business intelligence platform and Key Performance Indicator (KPI) dashboards that allow improved visibility to mission-critical data that 3PLs can then use to pinpoint problem areas.

Today’s transportation landscape calls for decisions to be informed and data-driven. Safety is no different, as continual improvement is key to minimizing risks while operating on the road and in the consumer’s home. TrueNorth recognized a need to formalize concepts and subject-matter expertise and as a result, developed Risk Solutions. Based on collaboration and a top-down adoption of core safety principles, Risk Solutions is comprised of iNERGY, TrueNorth’s proprietary business intelligence platform and Key Performance Indicator (KPI) dashboards that allow improved visibility to mission-critical data that 3PLs can then use to pinpoint problem areas.

Cultural Impact: The Risk Solutions platform appoints cross-functional, multi-level stakeholders within the enterprise to become members of a “risk council.” The council develops key performance indicators and charters specific goals that ultimately drive the business forward. These indicators are created in iNERGY and dashboards are generated for easy and ongoing access to real-time data. The council meets regularly to discuss progress and strategies for continuous improvement.

Quantifiable results from actual Risk Solutions engagements with Last Mile 3PL clients:

- 41% frequency reduction of Auto Liability claims

- 55% frequency reduction of in-home General Liability claims

- 40% severity reduction of in-home General Liability claims

- 80% frequency reduction of work-related injury and accident claims

TrueNorth’s focus also extends to our contract carrier clients. We’ve developed programs to increase contract carriers’ profitability and improve safety performance while lending them the tools necessary to support sustainability and maximize growth. The concept of a contract carrier “ecosystem” has evolved into a fully-functioning platform we call the Last Mile Independent Advantage.

Technology & Administrative Solutions

In an effort to continually pursue new ways to automate scalable and repeatable processes, TrueNorth helps 3PLs redeploy company resources to pursue revenue-generating opportunities while reducing risk tied to process failure.

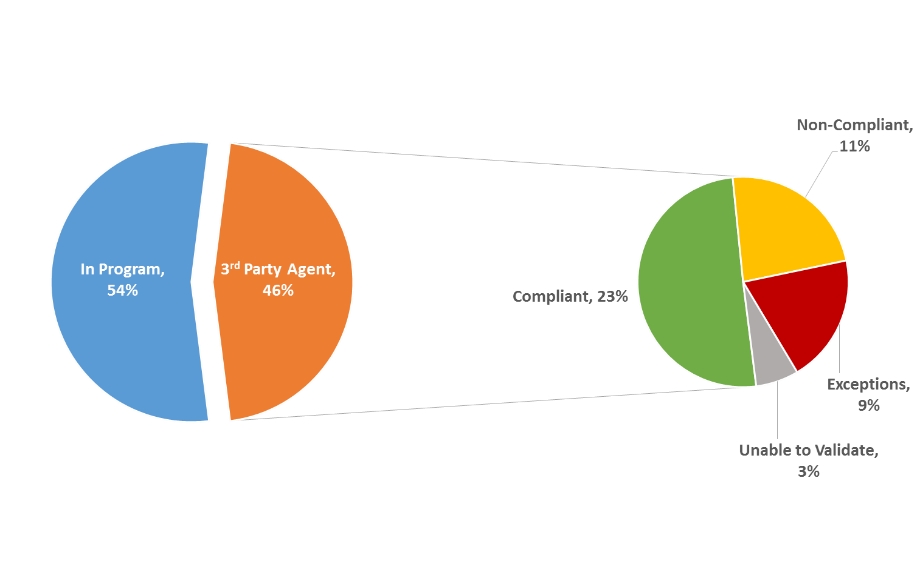

Third Party Insurance Compliance: Similar to our motor carrier authority assessment, TrueNorth reviews certificates of insurance (COI) for contractual insurance requirements. Over time, we have discovered that an alarming number of third party insurance policies are non-compliant. When these claims occur, policies are less likely to respond to and adequately cover the claim. This increases enterprise resource expenses that are tied to managing disputed claims and will increase overall insurance costs. The chart below illustrates our findings; 23% of existing third party insurance policies are non-compliant.

TrueNorth’s COI Compliance platform helps solve for this by deploying licensed insurance agents to review and assess certificates of insurance. We check for compliance and ensure policies are meeting contractual insurance requirements. In addition, we provide feedback to the contract carrier and/or their insurance agent, capture the contractor compliance data in our proprietary technology platform, and share web-based data to the 3PL for more effective capacity planning.

Risk Management Information Systems (RMIS) and Carrier Monitoring Software: TrueNorth supplies 3PL clients with a Risk Management Information System that streamlines claims workflows, reduces resource requirements tied to managing claims, and provides enterprise visibility and reporting for critical claims data. We have also implemented carrier monitoring software to reduce the risk of tendering freight to unauthorized and uninsured carriers.

Risk Transfer Strategies

TrueNorth’s four quadrant approach ensures a balanced and holistic approach to enterprise risk management. For risks the 3PL and TrueNorth cannot effectively manage, we agree to the concept of risk transfer – or put simply – insurance. We believe it is critical to architect strategies that anticipate the interplay between shipper, 3PL, contract carrier, and the end consumer, as illustrated below.

The tremendous growth within the Last Mile sector offers significant opportunities for our clients to grow market share and expand their operations. As companies grow, risk management and safety disciplines must evolve at the same pace. The fulcrum concept to the right illustrates this concept. Balanced growth is key to long-term stability and insurability. As TrueNorth continues to help clients manage these unique risks and exposures, it is critical that we capture both qualitative and quantitative evidence to help minimize the total cost of insurance.

The tremendous growth within the Last Mile sector offers significant opportunities for our clients to grow market share and expand their operations. As companies grow, risk management and safety disciplines must evolve at the same pace. The fulcrum concept to the right illustrates this concept. Balanced growth is key to long-term stability and insurability. As TrueNorth continues to help clients manage these unique risks and exposures, it is critical that we capture both qualitative and quantitative evidence to help minimize the total cost of insurance.

In addition, TrueNorth continues to dedicate significant resources to building programs that offer compliant insurance coverage to Last Mile contract carriers. TrueNorth takes a different approach by working closely with insurance carriers to build programs that properly contemplate risk and exposure in the last mile home delivery sector. The strategy results in a well-protected shipper, 3PL, contract carrier, and end-customer.

Access the electronic version of the press release at this link.